Recap for October 12

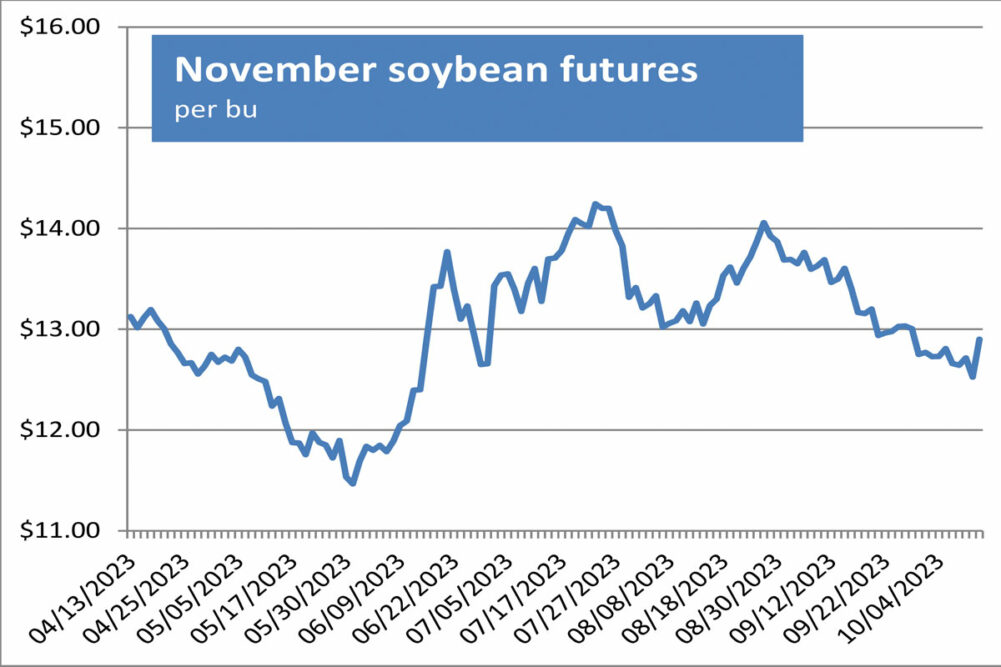

- US corn and soybean futures prices climbed Thursday after the USDA lowered its projections for the harvest of both crops as hot, dry weather during key development phases cut into yields. Wheat futures followed corn and soybeans higher despite non-supportive estimates from the USDA, which raised its estimate for the 2024 wheat carryover by 55 million bus from September. December corn futures gained 8¢ to settle at $4.96 per bu. Chicago December wheat packed on 15½¢ to close at $5.71½ per bu. Kansas City December wheat added 7¾¢ to close at $6.75 per bu. Minneapolis December wheat advanced 5¼¢ to close at $7.23½ per bu. November soybeans leaped 37½¢ to close at $12.90 per bu. October soybean meal rose $13.30 to close at $387.60 per ton. October soybean oil added 0.95¢ to close at 54.47¢ a lb.

- Commerce Department data showed inflation-squelching progress of summer took a pause in September and US equity markets closed lower. Data showed the Consumer Price Index rose 3.7% from September 2022, the same as in August. Core prices, which exclude the volatile food and energy categories, rose 4.1% from September 2022, down from 4.3% in August. The Dow Jones Industrial Average advanced 173.73 points, or 0.51%, to close at 33,631.14. The Standard & Poor’s 500 fell 27.34 points, or 0.62%, to settle at 4,349.61. The Nasdaq Composite dropped 85.46 points, or 0.63%, to close at 13,574.22.

- US crude oil declined again Thursday. The November West Texas Intermediate light, sweet crude future shed 58¢ to close at $82.91 per barrel.

- The US dollar index strengthened again Thursday.

- US gold futures busted its four-day win streak as the October contract dropped back $3.50 to close at $1,869.30 per oz.

Recap for October 11

- Soybean futures declined Wednesday despite expectations that the USDA would trim US soybean production and yields in its Oct. 12 Agricultural Supply and Demand Estimates (WASDE) report. The unexpected pressure came from ideas soybean yields and production would remain near the high end of trade estimates. Corn futures advanced ahead of the report in which analysts expected the USDA to drop corn production estimates from 15.134 billion bus in September to 15.101 billion bus and to drop corn yields from 173.8 bus per acre in the prior month to 173.5 bus an acre. The average domestic corn ending stock estimate was 2.138 billion bus, down from 2.221 billion bus in September. Wheat futures were lower under pressure from Black Sea wheat supplying the world market and as traders positioned themselves ahead of a WASDE report expected to show an increase in the USDA’s June 1, 2024, US wheat carryover. December corn futures added 2½¢ to settle at $4.88 per bu. Chicago December wheat dipped 2½¢ to close at $5.56 per bu. Kansas City December wheat dropped 4¢ to close at $6.67¼ per bu. Minneapolis December wheat declined 5¼¢ to close at $7.18¼ per bu. November soybeans dropped 19¢ to close at $12.52½ per bu. October soybean meal added $2.30 to close at $374.30 per ton; all subsequent months were lower. October soybean oil fell 0.47¢ to close at 53.52¢ a lb.

- US equity indexes extended their win streak to four days Wednesday as a swift run-up in bond yields pulled back and the Fed indicated it could be done with interest rate hikes as long as long-term yields remain near highs and inflation continues to cool. The Dow Jones Industrial Average advanced 65.57 points, or 0.19%, to close at 33,804.87. The Standard & Poor’s 500 gained 18.71 points, or 0.43%, to settle at 4,376.95. The Nasdaq Composite added 96.83 points, or 0.71%, to close at 13,659.68.

- US crude oil declined again Wednesday. The November West Texas Intermediate light, sweet crude future shed $2.48 to close at $83.49 per barrel.

- The US dollar index strengthened Wednesday.

- US gold futures continued higher for a fourth-straight trading day Wednesday. The October contract rose $11.80 to close at $1,872.80 per oz.

Recap for October 10

- Wheat futures were lower Tuesday, following declines in crude oil prices and Egypt’s purchase of 480,000 tonnes of wheat from Russia. Corn futures were lower as traders awaited harvest reports from the USDA that were delayed due to Monday’s federal holiday. Soybean futures were mostly higher on improved exports. December corn futures ticked down 2¾¢ to settle at $4.85½ per bu; later months were also lower but September 2025 and beyond were higher. Chicago December wheat lost 14¼¢ to close at $5.58½ per bu. Kansas City December wheat dropped 14¾¢ to close at $6.71¼ per bu. Minneapolis December wheat declined 7½¢ to close at $7.23½ per bu. November soybeans gained 7¼¢ to close at $12.71½ per bu; later months were mixed but mostly higher. October soybean meal added $1.10 to close at $372 per ton; later months were mixed but mostly higher. October soybean oil fell 2.14¢ to close at 53.99¢ a lb; later months were mixed but mostly lower.

- US equity markets continued to climb Tuesday. Geopolitical impact on the market was offset by investor supposition that the Federal Reserve had likely concluded its cycle of raising interest rates. Treasury yields slipped back from their 16-year peaks, providing additional support to stocks. The Dow Jones Industrial Average advanced 134.65 points, or 0.40%, to close at 33,739.30. The Standard & Poor’s 500 gained 22.58 points, or 0.52%, to settle at 4,358.24. The Nasdaq Composite added 78.60 points, or 0.58%, to close at 13,562.84.

- US crude oil declined Tuesday. The November West Texas Intermediate light, sweet crude future gave back 41¢ to close at $85.89 per barrel.

- The US dollar index weakened Tuesday.

- US gold futures notched gains for a third straight session on Tuesday. The October contract rose $11.50 to close at $1,861.00 per oz.

Recap for October 6

- US crude oil prices rose 4% Monday, mostly in response to war being waged between Israel and Palestine after Hamas militants attacked hundreds of Israeli citizens over the weekend at a music festival near the Gaza border. The November West Texas Intermediate light, sweet crude future added $3.59 to close at $86.38 per barrel.

- Wheat futures were higher Monday following the weekend surprise attack on Israeli civilians by Hamas militants, which instilled renewed market uncertainty. Continued concerns about dryness impacting crops in Australia and Argentina also added support. Both corn and soybean futures edged lower on trader positioning ahead of USDA reports due to be released later this week. December corn futures gave back 3¾¢ to settle at $4.88¼ per bu. Chicago December wheat gained 4½¢ to close at $5.72¾ per bu. Kansas City December wheat advanced 12¼¢ to close at $6.86 per bu. Minneapolis December wheat rose 10½¢ to close at $7.31 per bu. November soybeans slipped 1¾¢ to close at $12.64¼ per bu. October soybean meal added $3.30 to close at $370.90 per ton. October soybean oil dropped 1.16¢ to close at 56.13¢ a lb.

- US equity markets were higher as investors processed potential market impacts from the recent Israel-Palestine conflict. Defense-related stocks notched large gains before the closing bell. General Dynamics settled more than 8% higher while Lockheed Martin was up nearly 9% and Northrup Grumman rocketed up more than 11%. The Dow Jones Industrial Average advanced 197.07 points, or 0.59%, to close at 33,604.65. The Standard & Poor’s 500 gained 27.16 points, or 0.63%, to settle at 4,335.66. The Nasdaq Composite added 52.90 points, or 0.39%, to close at 13,484.24.

- The US dollar index was slightly higher Monday.

- US gold futures continued to climb Monday. The October contract jumped $19.30 to close at $1,849.50 per oz.

Recap for October 5

- Wheat futures continued to bounce off last week’s contract lows with the support of Black Sea news. A Turkish vessel headed for Ukraine ports to load grain struck a sea mine of Romania. No one was injured and the vessel continued toward its destination. Corn prices also rallied on the Black Sea news, climbing to their highest levels in more than a month. Soybean futures were higher, in bargain buying and with the support from the wheat and corn rallies, although gains were limited by lackluster export demand, falling energy prices and signs of an ample US crop now well into its harvest. December corn futures added 11½¢ to settle at $4.97½ per bu. Chicago December wheat added 18¼¢ to close at $5.78¼ per bu. Kansas City December wheat jumped 24¢ to close at $6.90½ per bu. Minneapolis December wheat advanced 19¾¢ to close at $7.31½ per bu. November soybeans rose 7¾¢ to close at $12.80¾ per bu. October soybean meal added $4.90 to close at $373.60 per ton. October soybean oil fell 0.57¢ to close at 57.86¢ a lb.

- US equity markets spent most of the day lower, turned briefly higher, but were down again at closing bells as investors looked ahead to Friday’s report on US employment figures for September. The pre-report holding pattern was broken by a second straight decline in the yield on the benchmark 10-year US Treasury note, which ended Thursday at 4.715%, down from 4.735% on Wednesday. On Tuesday, it rose to 4.801%, its highest 3 p.m. yield since August 2007. The Dow Jones Industrial Average fell 9.98 points, or 0.03%, to close at 33,119.57. The Standard & Poor’s 500 fell 5.56 points, or 0.13%, to settle at 4,258.19. The Nasdaq Composite declined 16.18 points, or 0.12%, to close at 13,219.83.

- US crude oil prices again dropped lower Thursday. The November West Texas Intermediate light, sweet crude future fell $1.91 to close at $82.31 per barrel.

- The US dollar index eased again on Thursday.

- US gold futures dropped again Thursday. The October contract lost $1.90 to close at $1,816.60 per oz.

| Fresh ideas. Served daily. Subscribe to Food Business News’ free newsletters to stay up to date about the latest food and beverage news. |

Subscribe |